QuickBooks Payroll:

3 Things You Need to Know

.png?v=1668101067951)

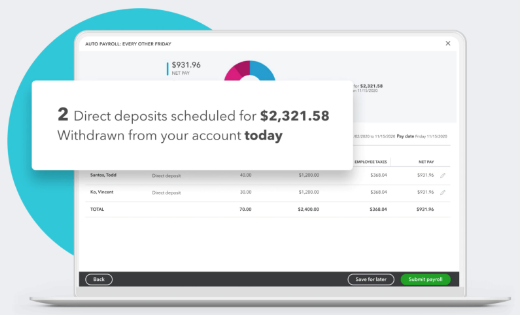

Take payroll off your plate

As a small business owner, you’re being pulled in many directions. Worrying about payroll doesn’t have to be one of them. QuickBooks Online Payroll is seamlessly embedded in QuickBooks Online, making it easy for you to manage your data, and straightforward for your employees to view their paychecks and essential documents. Setting up Auto Payroll keeps time on your side and same-day direct deposit ensures your employees get paid on time with no worry of last-minute adjustments or lost and compromised paper checks.

From payday to tax time

Breathe easy year-round and at tax time with QuickBooks Payroll on your side to automatically calculate, file, and pay your federal and state payroll taxes for you. Get the extra coverage of payroll tax penalty protection. If you receive a federal, state, or local payroll tax penalty from an error, QuickBooks will help resolve it and reimburse any penalty and interest cost.

Big business benefits, small business budget

Staying HR compliant while growing your business has never been easier. Access a trove of employee services - from HR support to 401(k) plans - with QuickBooks Payroll. With Payroll, you can access tools and templates to help customize job descriptions, onboard new employees, and boost performance, all with HR advisors by your side.

Offer employees health through SimplyInsured, 401(k) plans with Guideline, and get peace of mind with pay-as-you-go workers' comp insurance with the help of QuickBooks' trusted broker AP Intego.

We’ll handle the tedious tasks so you can focus on the big picture.